Browse by Solutions

Browse by Solutions

How to Setup Invoices Tax Code for the Province of Alberta, Canada?

Updated on May 1, 2018 11:08PM by Admin

In Canada, three types of sales taxes are levied. They are as follows.

- Provincial Sales Taxes(PST)

- Goods and Services Tax(GST)

- Harmonized Sales Tax(HST), a combination of PST and GST

In the province of Alberta (Canada), Goods and Services Tax (GST) of 5% is levied.

Steps to Setup Invoice Tax Rates

- Log in and access Invoices App from your universal navigation menu bar.

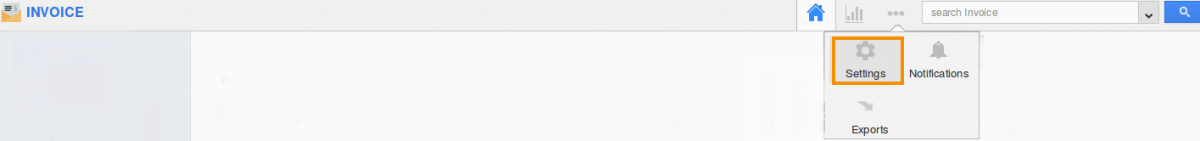

- Click on “More” icon and select "Settings" at the app header bar.

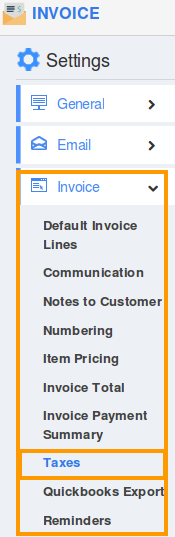

- Click on “Invoice” and select "Taxes" from the left navigation panel.

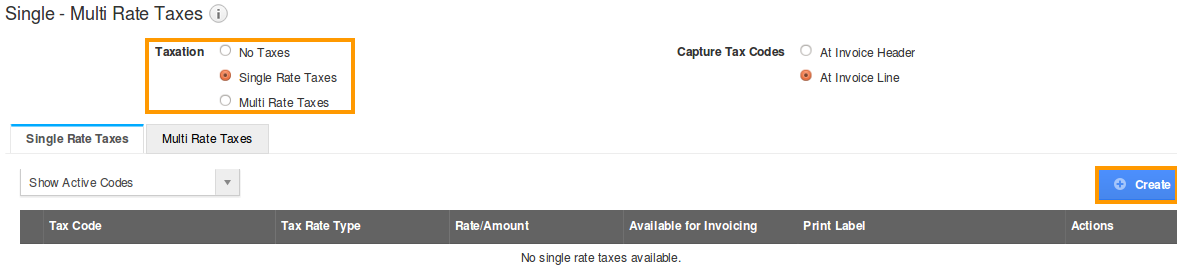

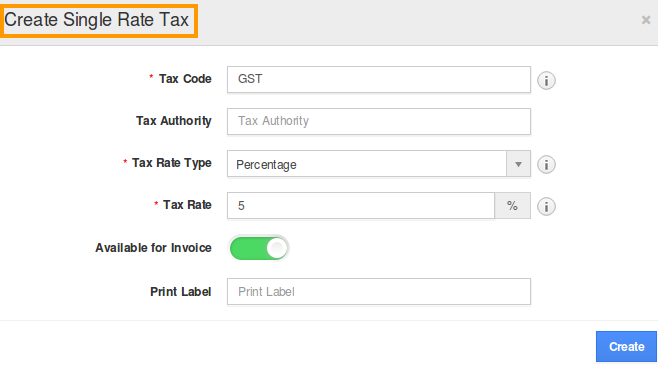

- Select “Single Rate Taxes” and make sure to click “Create” button.

- Provide tax code, tax rate type and percentage.

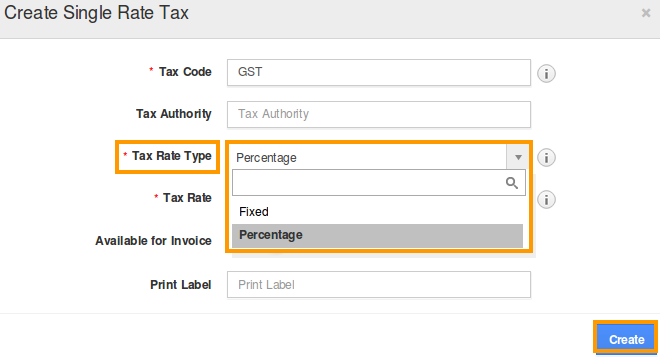

- In Tax rate type, there are two options:

- Fixed: Standard tax amount for goods and services.

- Percentage: It refers to proportion of taxes to be levied on goods and services.

- Select any one from above and Click “Create” to complete tax settings.

Reference : Goods and services tax (GST) rates in the Province of Alberta, Canada is referred from Wikipedia(Sales Tax, Canada)

Flag Question

Please explain why you are flagging this content (spam, duplicate question, inappropriate language, etc):