Browse by Solutions

Browse by Solutions

How do I Configure Invoices Feature?

Updated on January 2, 2020 04:19AM by Admin

The Invoices App lets you bill customers easily, and integrates with sales information already stored. Customers can pay online instantly with a link sent via email, or download a PDF to pay manually. All that you have to do is configure the Invoice app settings. Here we go.

Steps to Configure Invoice Settings

- Log in and access Invoices App from your universal navigation menu bar.

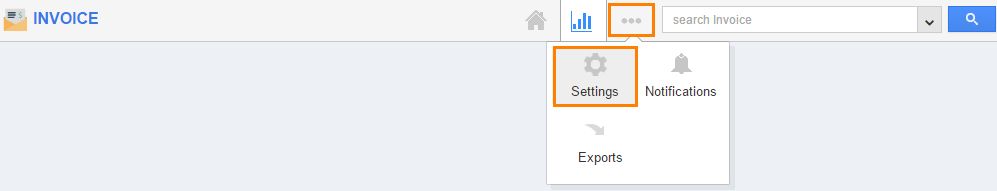

- Click on “More” icon and select "Settings" at the app header bar.

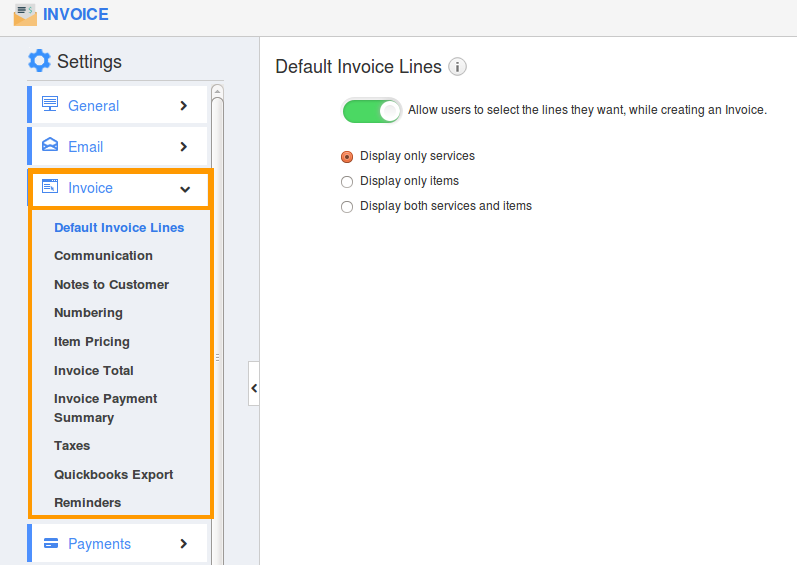

- Click on "Invoice" from left navigation panel.

- Invoice Configuration option includes:

- Default Invoice Line

This setting allows you to determine what types of invoice your business creates. Selecting services or products here will skip this step when creating a new invoice. Leave this setting blank if you would like to choose the invoice type when creating each invoice. - Communication

This setting allows you to customize communication type. - Notes to Customer

Provide description to the customer to be sent along with the email. - Numbering

You can auto generate or manually generate invoice reference number. If you would like to auto generate numbers, then provide: Prefix and Starts with - Item Pricing

Enabling this setting allows you to change the price of a product when creating an invoice. The default price will pre-populate, but you will be able to edit if desired. When disabled, you cannot change the price of a product from within an invoice. - Invoice Total

It shows customer's unpaid invoice total in invoice total due. - Invoice Payment Summary

It displays invoice payment summary in the overview dashboard. - Taxes

While creating new invoices, tax code capture levels are used to configure the place where the tax code needs to be shown on an invoice. Few customers would like the sales tax code to be shown with product/services sold and few others would like the tax code to be shown along with general invoice details. - QuickBooks Export

In this setting, you are able to export your invoices, and all related data such as customers, products, and payments. You are able to select the desired set of invoices, then download the data in a IIF file. This file can be easily imported into your QuickBooks desktop edition. - Reminders

Automatic email reminders are managed in Settings where you can create one or more to apply to your invoices. These can be removed, disabled or edited at any time, for instance if your payment terms change. Create and send invoice to customer, if your invoice goes unpaid. This will use all the active reminder rules for your invoice.

Related Links

Flag Question

Please explain why you are flagging this content (spam, duplicate question, inappropriate language, etc):