Browse by Solutions

Browse by Solutions

What are the Tax Code levels in Invoices App Tax Settings?

Updated on February 27, 2017 05:32AM by Admin

While creating new invoices, tax code capture levels are used to configure the place where the tax code needs to be shown on an invoice. Few customers would like the sales tax code to be shown with product/services sold and few others would like the tax code to be shown along with general invoice details. Depending on the versatile needs of the customers, invoices tax code capture level has been categorized into two types:

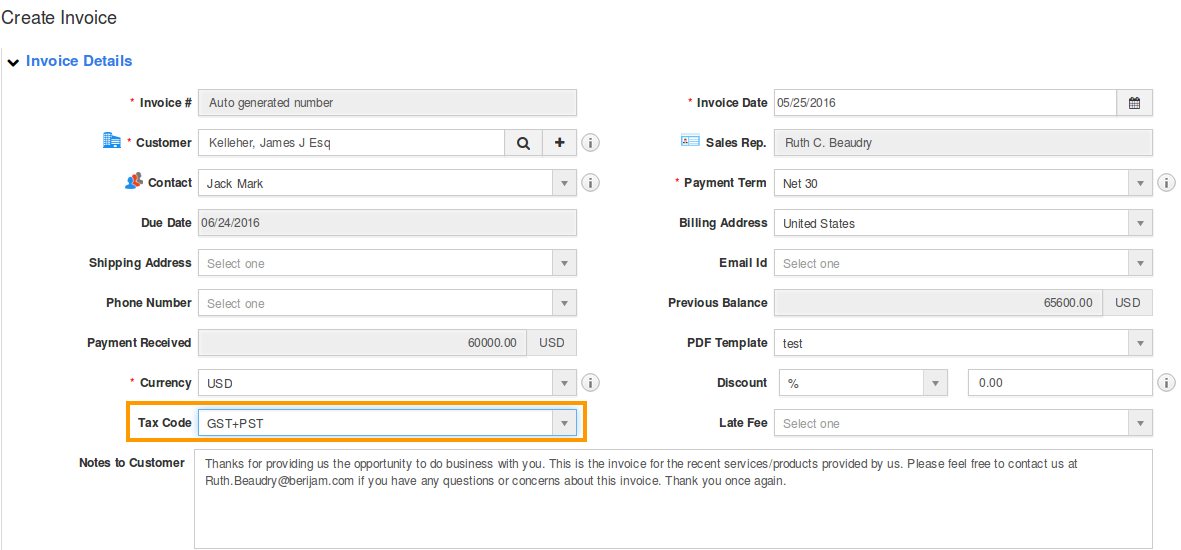

Invoices Header Level Tax Code

The tax code captured for an invoice will be shown in the invoice details' column at the top. And you will have this one single tax code that applies to all items on the invoices.

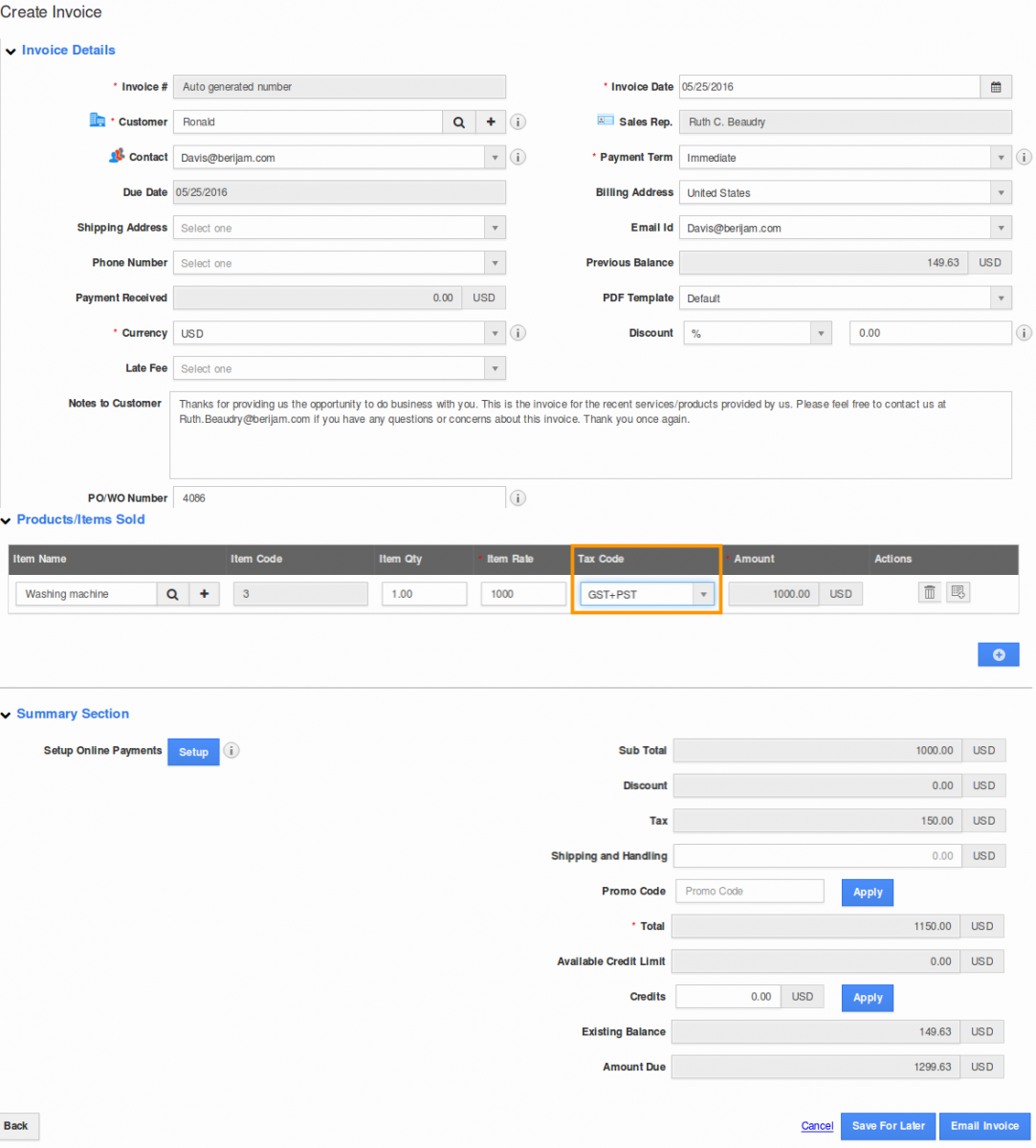

Invoices Line Level Tax Code

The tax code captured for an invoice will be shown along with Products/items sold at the bottom. A different tax code (or no tax) can be applied to each individual product or service.

You can select any of these above types, based upon your business needs. Thereafter invoices created will be based upon the tax code level configured.

Follow the link to know more about Invoices tax code settings in various countries.