Browse by Solutions

Browse by Solutions

How to setup Invoices Tax code for Kenya, East Africa?

Updated on April 8, 2018 10:41PM by Admin

Apptivo users in Kenya, East Africa can easily set up their online invoices to charge for the goods and service taxes. In the province of Kenya, they charge for electricity/fuel at the rate of 16% / 12% and withholding tax at the rate of 12.5%. You can use Apptivo multi rate tax codes calculator to make these tax rates available for use while creating invoices.The tax code followed in the Province of Kenya, East Africa are as follows.

- Electricity / Fuel, which is calculated at the rate of 16% / 12%.

- Additionally withholding tax at the rate of 12.5%

Steps to Configure Taxes on Invoices App settings

- Log in and access Invoices App from your universal navigation menu bar.

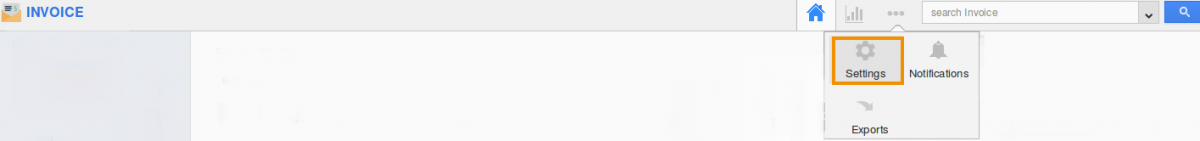

- Click on “More” icon and select "Settings" located in the app header bar.

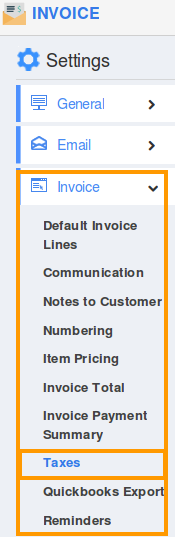

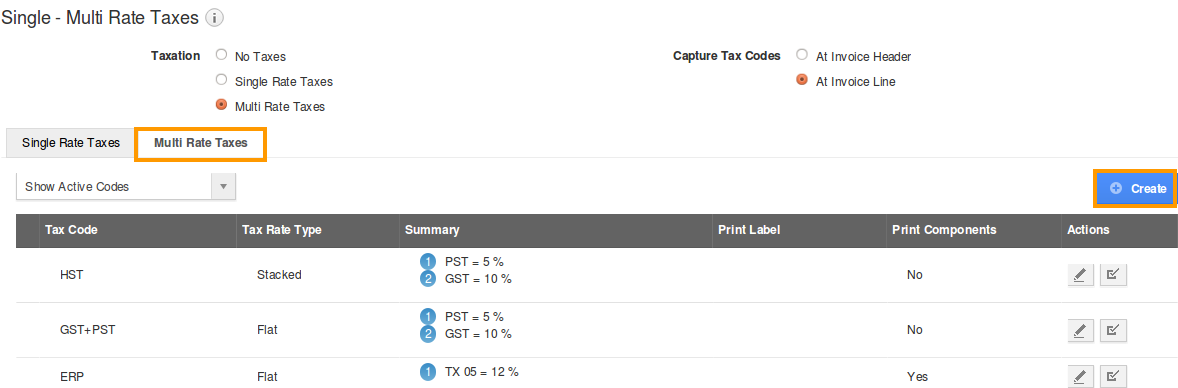

- Click on "Invoice” dropdown and select "Taxes" from the left navigation panel.

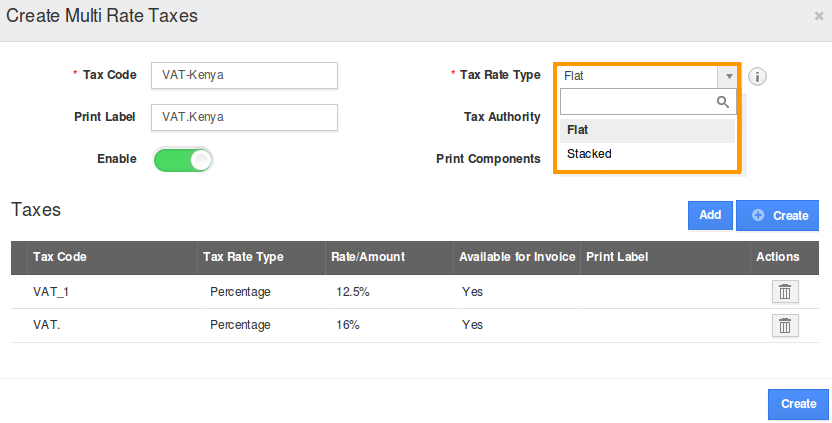

- Select “Multi Rate Taxes” and click on “Create” button.

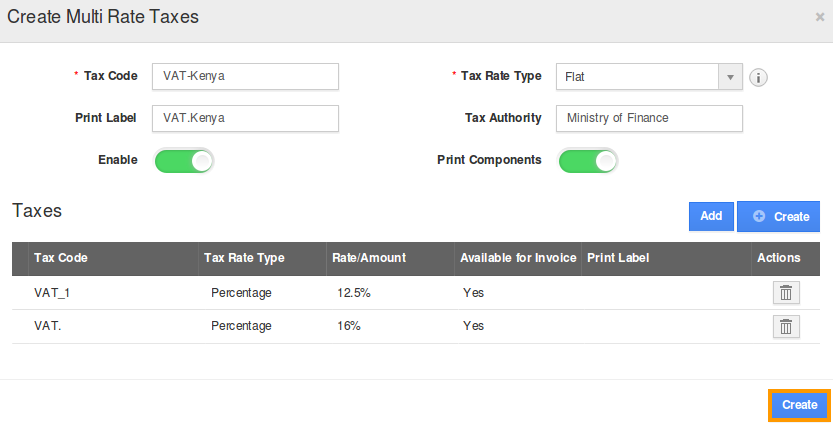

- You can view multi tax rate pop-up to “Create” or “Add” taxes from the list.

- If you create tax, provide tax code, tax rate type and percentage.

- In tax rate type, there are two options:

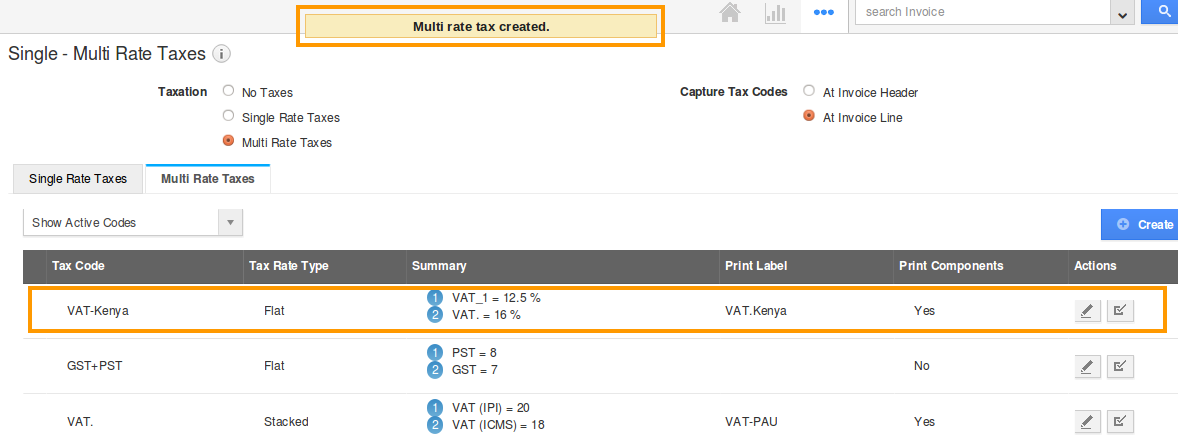

- Click “create” to get done with your multi tax formation, which indicates with a tax code created popup.

- In capturing tax codes, two options are provided:

- Now, we proceed with creating a new invoice with the above settings.

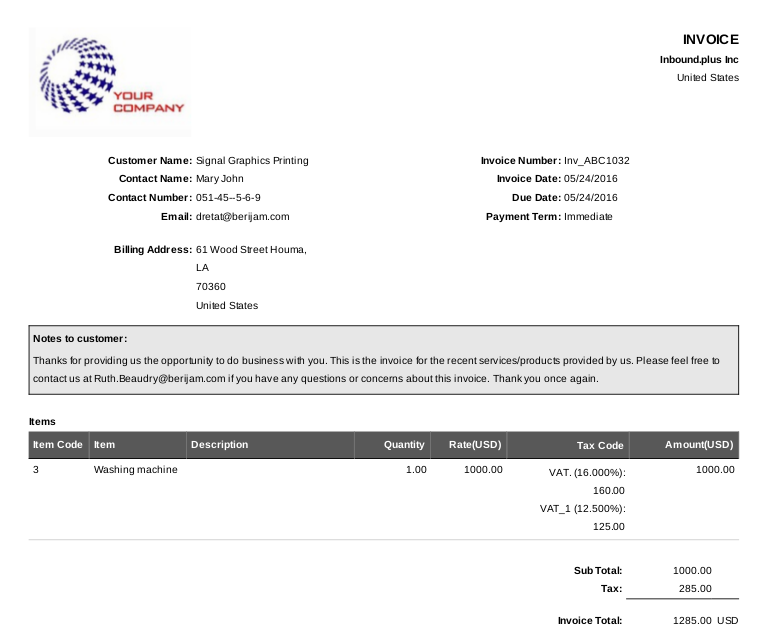

- You can either Email an invoice with PDF attachment or manually print invoice to be provided to your customer.

- This is how a customer views Invoice tax code items subtotals in PDF format.

Follow this link to know more about Invoices tax code followed in various countries

Related Links

Read more about:

Flag Question

Please explain why you are flagging this content (spam, duplicate question, inappropriate language, etc):