Browse by Solutions

Browse by Solutions

How to Setup Invoices Tax code for the Province of British Columbia?

Updated on May 1, 2018 11:37PM by Admin

In British Columbia, Goods and Service Tax (GST) + Provisional Sales Tax (PST) tax is levied. GST+PST is 12 percent, which is a combination of 5 percent federal and 7 percent provincial taxes.

Steps to Setup Tax Rates for Columbia

- Log in and access Invoices App from your universal navigation menu bar.

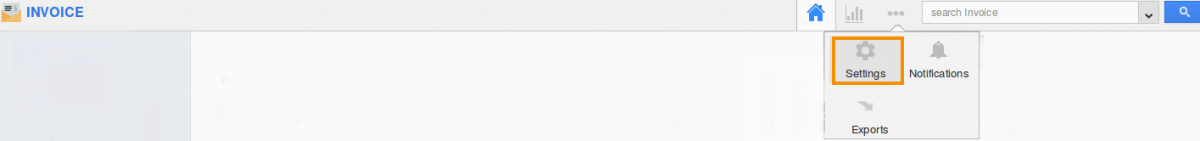

- Click on "More" icon and select "Settings" at the app header bar.

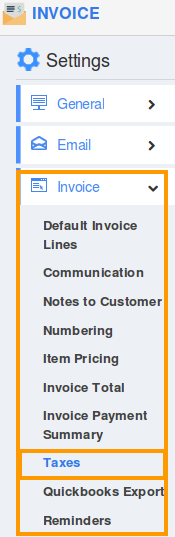

- Select "Taxes" from the left navigation panel.

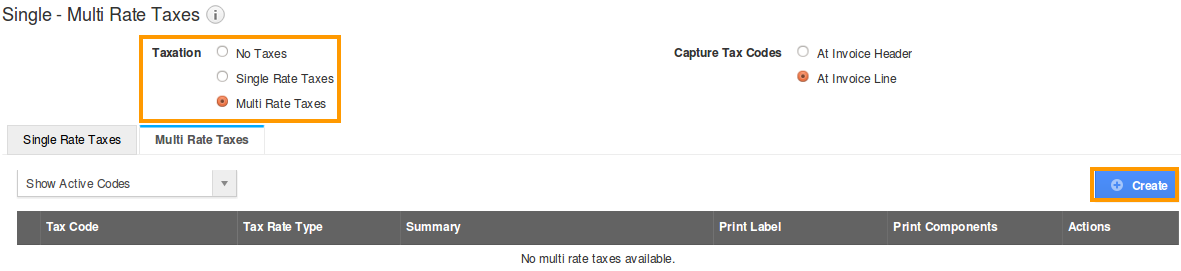

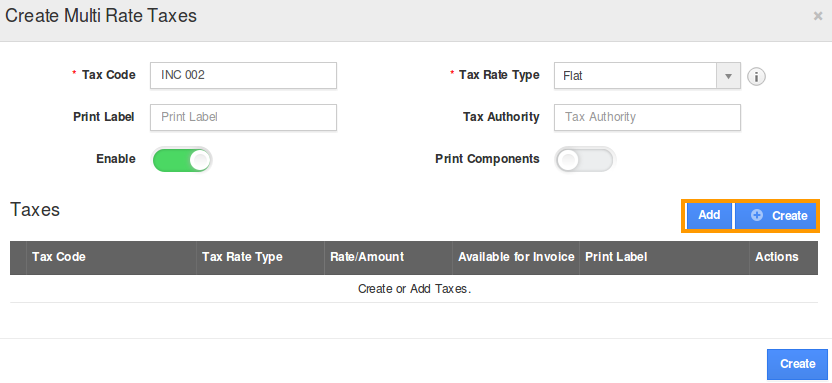

- Select “Multi Rate Taxes” and click on “Create” button.

- Create new tax or click "Add" button to add existing tax.

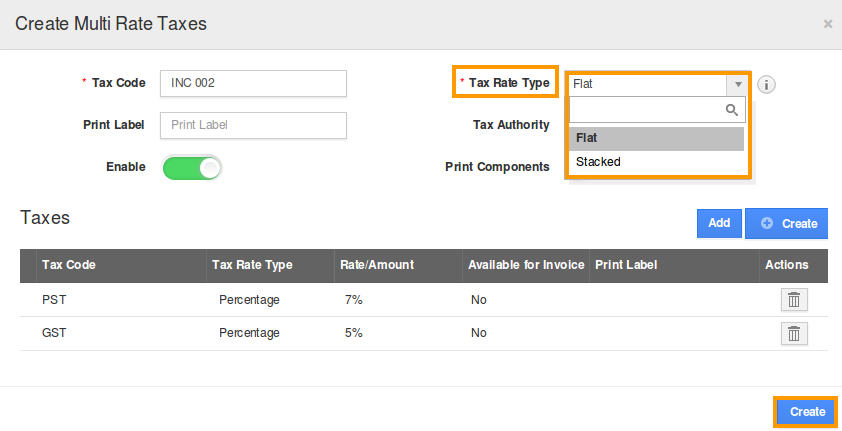

- Provide the tax code, tax rate type and percentage

- In Tax rate type, there are two options:

- Flat : It’s an overall combination of the taxation levied on a product or service

- Stacked: It’s the tax levied on a separate product alone, when there is a combination of two or more produc

- Select any one from above and click “Create” to complete your tax setup.

Flag Question

Please explain why you are flagging this content (spam, duplicate question, inappropriate language, etc):