As you all know!! In accounts the three important golden rules plays a vital role. All the entries are made only with the help of those real, nominal & personal accounts. These three things revolves around the two main keywords that is credit & the debit. The money can either be debited nor be credited to any of the account. So if the entries which are made correctly with those rules then the account will be tallied without any concern. However remembering all those is not an easy part, so we need a system to make all these countable for the year-end analysis. We might have seen the ledger apps which loads all the transactions and journal entries. But all these has to be entered manually, here we introduced a rule called accounting rule.

Accounting rule helps to fetch the particular transaction of invoices to the correct journal entry. Here you can set your own criteria and debit or credit the invoice amount to that particular journal entry. So once the trigger is created, then automatically all the invoices amounts with those criteria will be sent to the ledger.

Accounting rules and its criteria’s

In Order to create an accounting rule under the invoice, we need to make sure that the option is enabled under the settings page. Once the option is enabled you can click the create button and set your own accounting rules for your business.

Here, you have to do the below things to make your accounting rule unique and easy to identify from the other lists,

- Name the accounting rule

- Description of the rule on how it can be used

- Event can be neither be created nor updated

- Can set priority score

- Option to select period from any of the dates which is used in the invoice

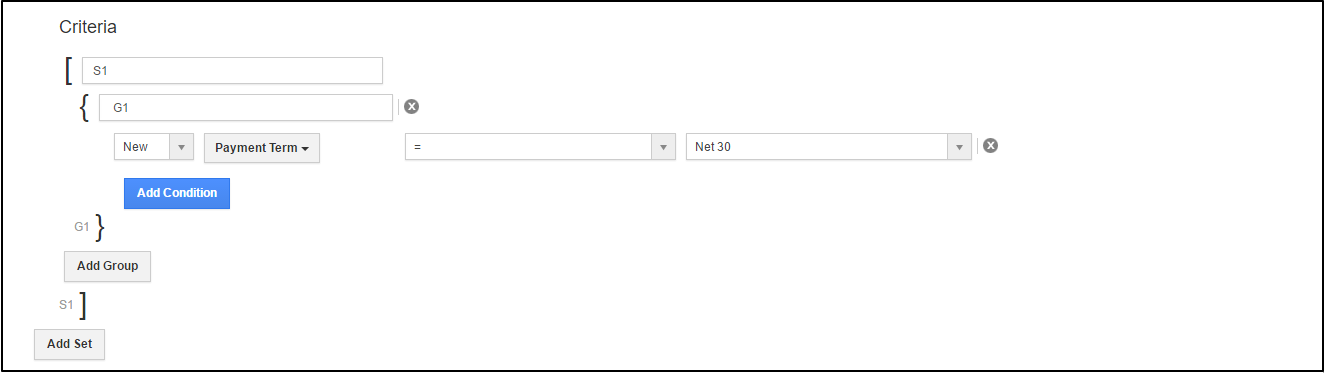

- Set criterias

Criteria’s can be set to make a condition on where the transaction must be pulled from and the base value can be entered. So if the condition satisfies the particular value then it will be sent to the journal entry which is set for any type of conditions. You can create as many conditions you want by using the “Add condition” button.

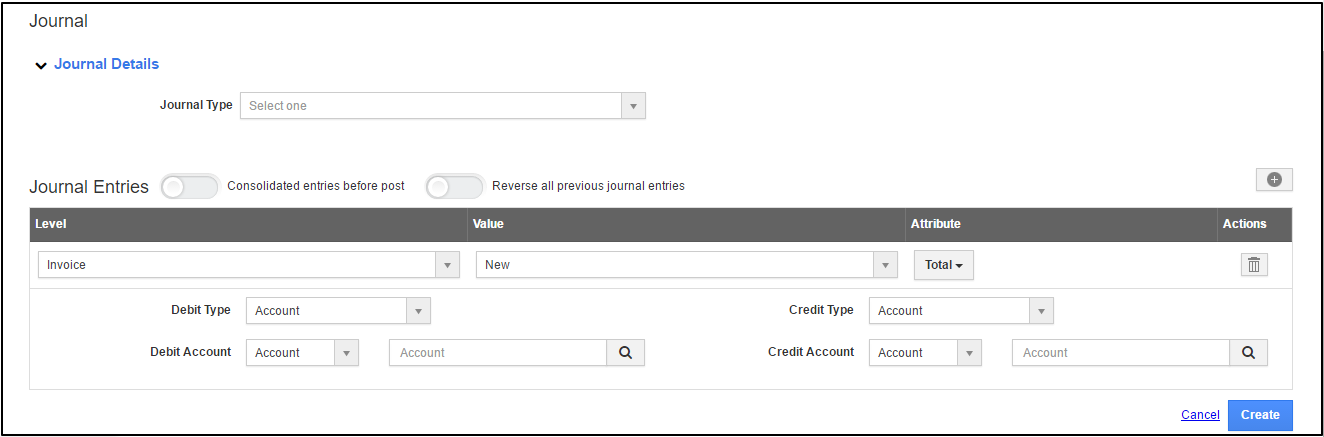

Journal entries on accounting rule:

We can use the criteria option to set the conditions and it fetches the amount from the invoice. After fetching the amount it should be tracked into the correct journal entry. For that we need to first of select any of the journal type like adjustments, accrual or reverse. The condition may change according to the journal type then you need to select from where the invoice amount should be fetched, old invoice or the new one and the attribute which is associated to the invoice. Then you need to give the details like where the amount should be credited and where it should be debited.

Once for all, everything is done right then the amount will be transferred to the correct journal entry and it will be useful for the yearend analysis. Accounting rule is one of the new feature of our version 6, and we have many more amazing features which helps the users in all possible ways. We can check out those in the coming blogs. Stay with us!!

Below is the video which explains the in and out process of accounting rule on invoices

Latest Blogs

Role Of CRM In Travel And Tourism Industry

Travel and tourism have been a significant part of everyone’s life since the ancient period. When we skim through the pages of history, It should be noted that humans were initially nomads before they became settled in one place. They...

Read more →

WHAT IS CRM TECHNOLOGY?

Introduction CRM is a technology that helps manage the entire customer information and interactions in order to build and maintain superior customer relationships. The CRM solution replaces spreadsheets and other different applications, which makes it easy for the businesses to...

Read more →

Everything you need to know about the Annual Maintenance Contract!

1. What is an Annual Maintenance Contract? 2. Benefits of Maintenance Contracts 3. How can Apptivo CRM help you manage maintenance agreements and vendors? 4. Summary Think about getting the confidence that the machinery is well-maintained and performing optimally, without...

Read more →