Mostly the reports are used to track a particular set of information in a specified way. The reports can be of any form like graphics, images, voices, or any type of vocabulary. The normal reports are used to track the work which is associated with a particular period. The past discussions were generally on the creation of the invoice and now we are going to see the walk-through on the reports which can be taken from the invoice software to satisfy the customer’s needs. In our invoice, we have a set of report functionalities, Which are completely designed for the customer perspective and the reports are,

General Reports:

General reports focuses on the reports which is created for the general purpose for the customers. The below is the set of reports which can be driven using our invoice software,

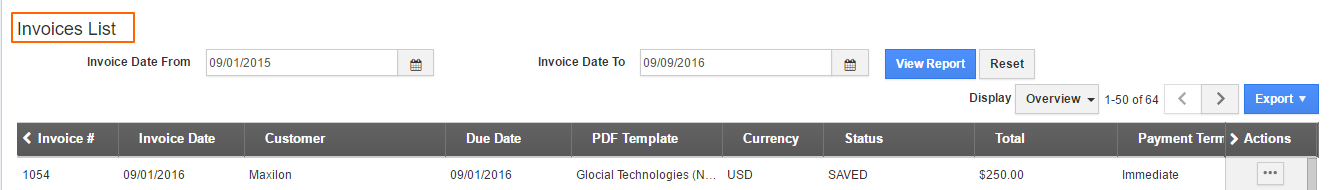

Invoice List:

Invoice list helps to take the report for the particular period. For instance: if john wants to check the list of invoices which is sent for the particular days, week or month. Then he can use this option to retrieve the same.

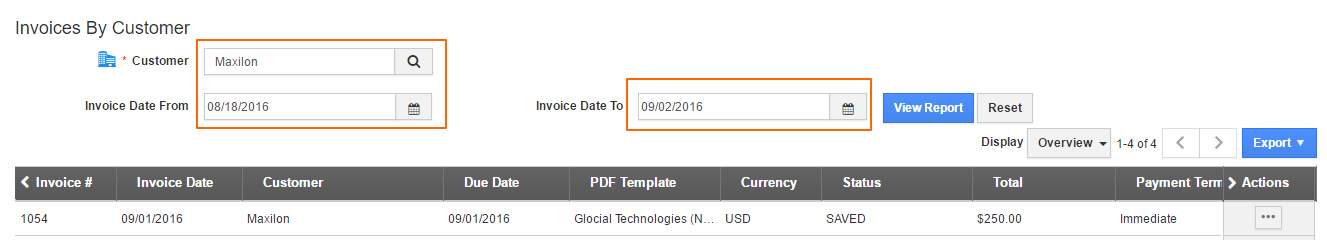

Invoice by Customer:

Invoice by Customer option helps to generate the reports for the particular customer. For instance: if sam wants to take the report for the selected customer to whom he has sent the invoice for the particular period he can use this option.

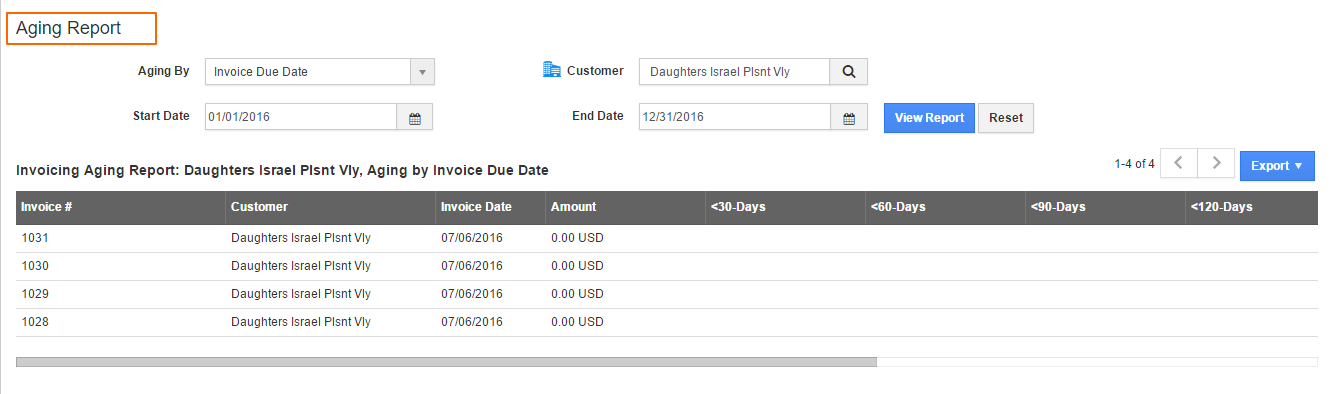

Aging Report:

Aging report option lets you to take the old invoice reports, It pops up with two option of the aging should be either with invoice due date or invoice date. Once selected any of the one it ask you to select the customer you wish with the start & end date. Which will pull up all the aging invoices for the selected dates.

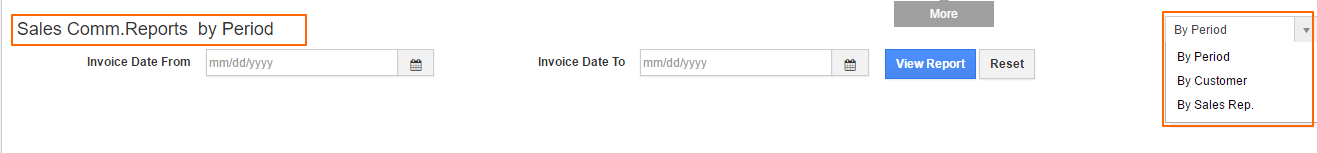

Sales.Comm Reports:

The invoice sales commission would be given to the customers or representatives for any business reason. While selecting this report it will pop up with three options period, customer and sales representative. With this you can take the report of the sales commission given for the particular period or to find out the total sales commission given to the selected customer or to the particular sales representatives can be found using these reports.

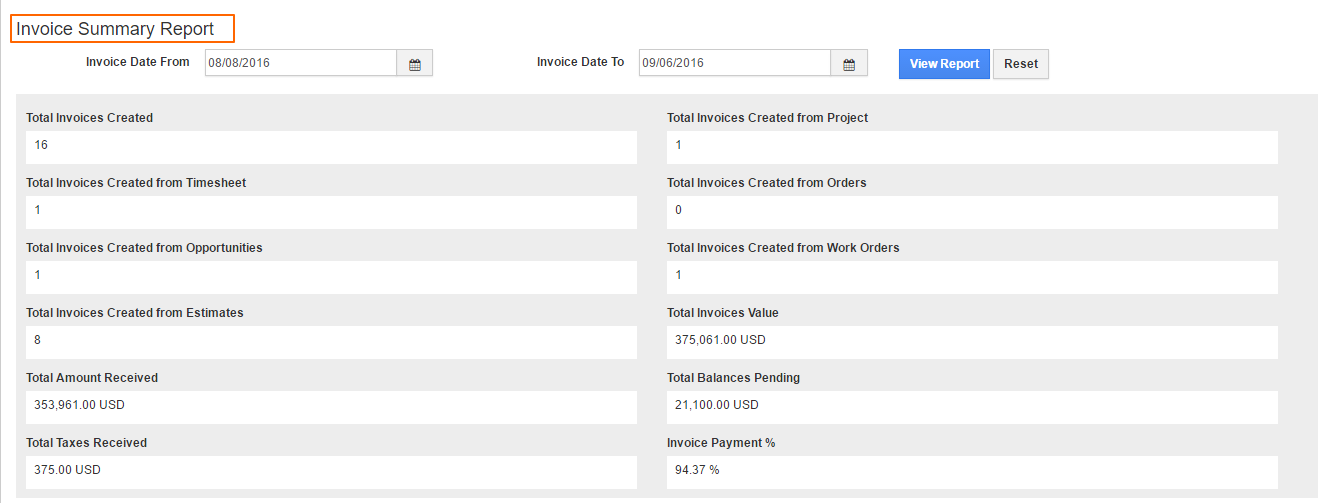

Invoice Summary Report:

Invoice summary report helps to take the report for the particular period. For instance, if john wants to check the list of invoices which is sent for the particular days, week or month. Then he can use this option to retrieve the same.

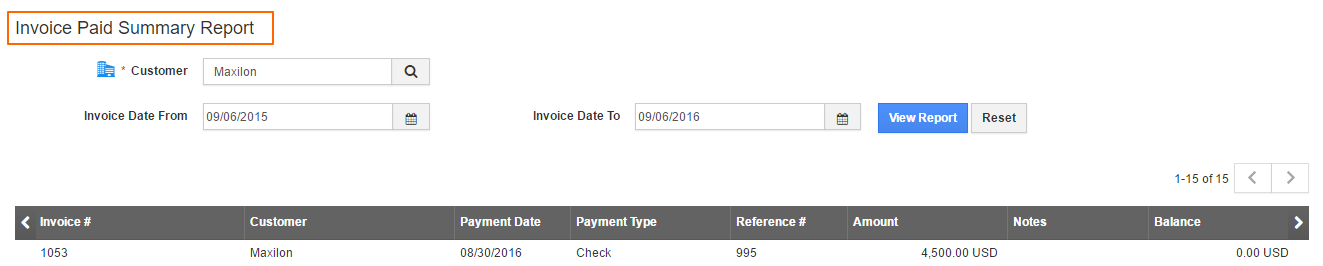

Invoice Paid Summary Report:

The invoice paid summary option is used to summarize the list of invoices which has been sent to the selected customer for the particular period.

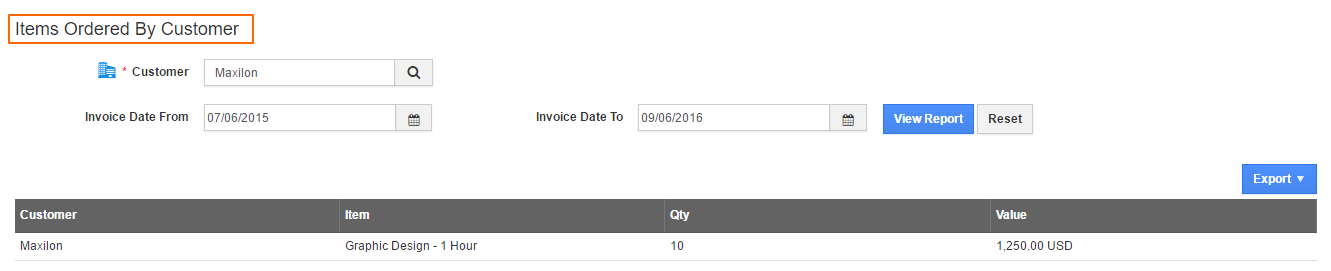

Items Ordered by Customer:

This option helps to create the report for the customer for the particular set of items. For instance, if julie wants to take report for the list of invoices of which the customers has purchased the particular items.

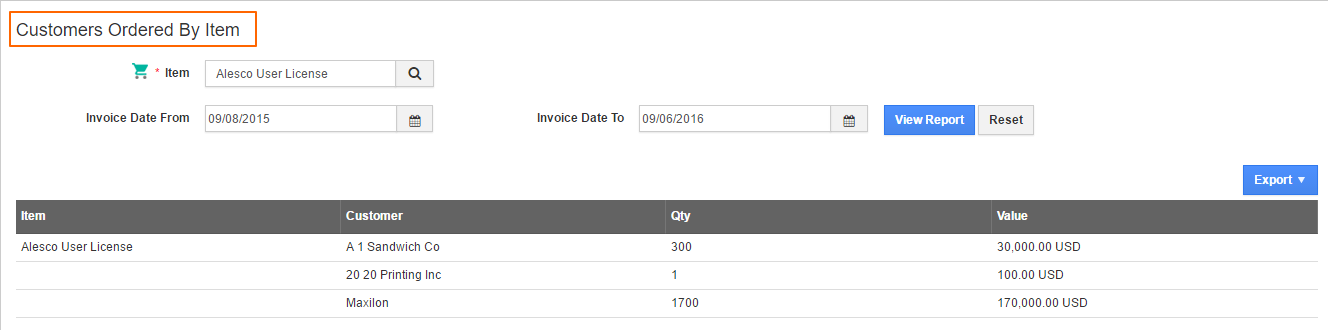

Customers ordered by Item:

It helps to take report on the invoices of the customers who had ordered the same set of items.

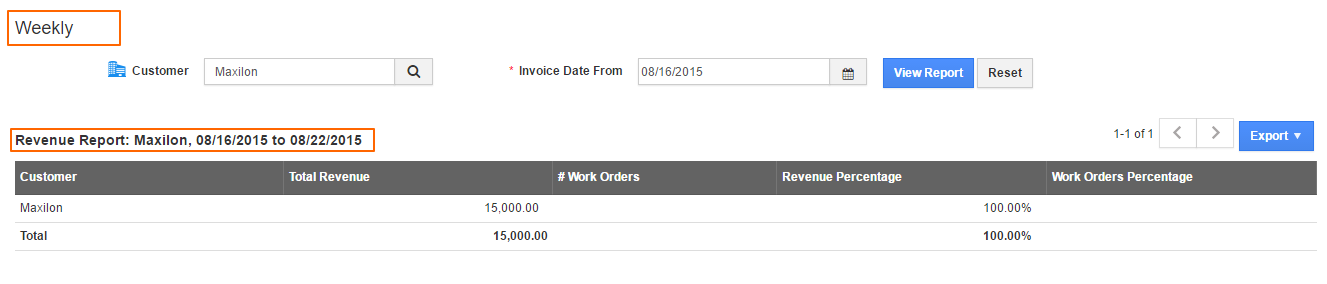

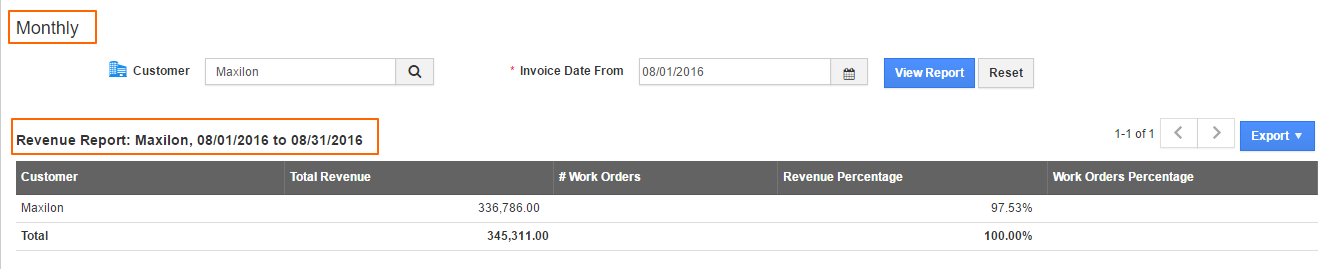

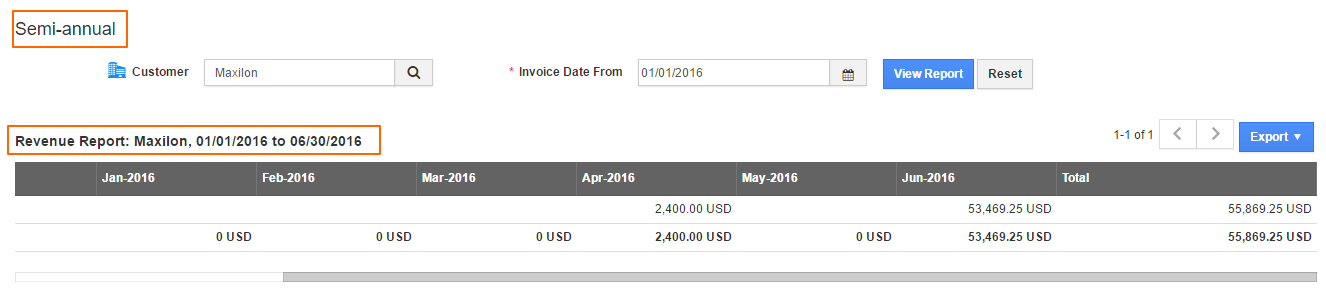

Revenue Report:

The revenue reports are usually used to find out the revenue of the particular customer. This can be validated through the invoices which has been sent to them. The revenue can be calculated in the below methods,

Weekly- It helps to track the weekly revenue of the particular customer

Monthly- It helps to track the monthly revenue of the particular customer

Semi-Annual- It helps to track the semi-annual revenue of the particular customer

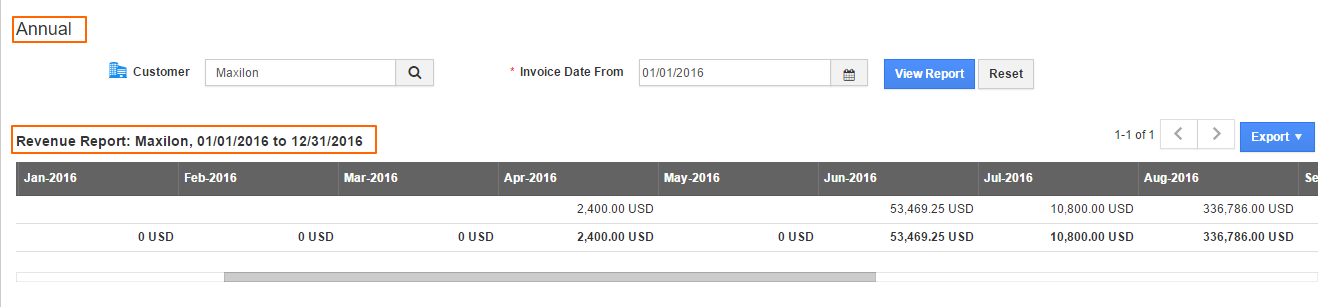

Annual- It helps to track the annual revenue of the particular customer

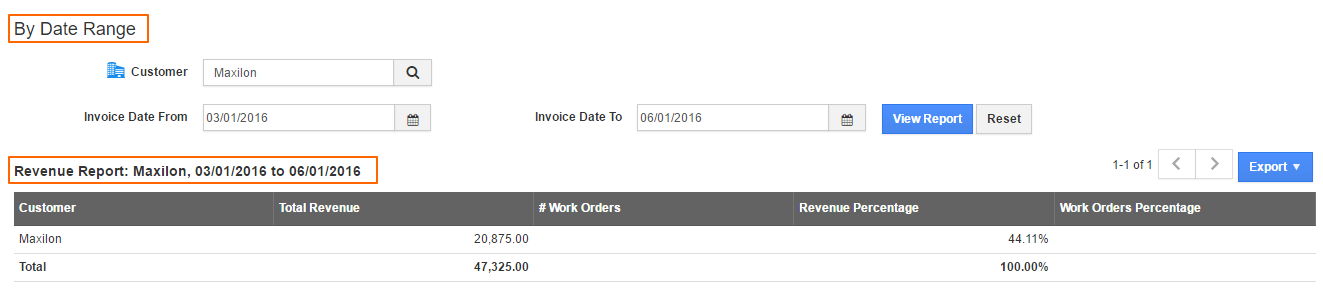

By Date Range- It helps to track the revenue of the customer in a selected period

Tax Report:

Tax is a financial charge and which has been charged to meet the public expenditures. Tax deduction should happen to all the benefits given to the public. So whenever the invoice is sent to the customers the tax will be deducted according to the government rules and conditions.

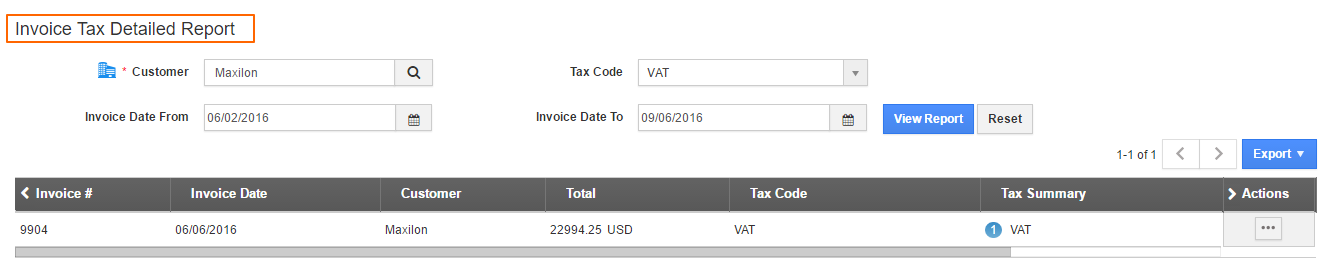

Invoice Tax Detailed Report:

Invoice Tax Detailed reports guides to take the report on the specific tax code to the particular customer. The report can be tracked with the date range. For instance, if the customer A has used the tax code CAD for many number of times in a specific period to send an invoice. We can track those invoice using this option.

Well, you would have had an idea on how our invoice software reports works for the users. We are still waiting to discuss on the amazing topics of new features . Stay with us to know more!!

Latest Blogs

Role Of CRM In Travel And Tourism Industry

Travel and tourism have been a significant part of everyone’s life since the ancient period. When we skim through the pages of history, It should be noted that humans were initially nomads before they became settled in one place. They...

Read more →

WHAT IS CRM TECHNOLOGY?

Introduction CRM is a technology that helps manage the entire customer information and interactions in order to build and maintain superior customer relationships. The CRM solution replaces spreadsheets and other different applications, which makes it easy for the businesses to...

Read more →

Everything you need to know about the Annual Maintenance Contract!

1. What is an Annual Maintenance Contract? 2. Benefits of Maintenance Contracts 3. How can Apptivo CRM help you manage maintenance agreements and vendors? 4. Summary Think about getting the confidence that the machinery is well-maintained and performing optimally, without...

Read more →