|

As quoted by Shep Hyken, “A brand is defined by the customer’s experience. The experience is delivered by the employees”. This statement is a powerful one that defines the complete relationship between a company’s employees and their customers. Employees bridge the gap between customers and a business. They connect the dots, assist in overcoming the drawbacks associated with a product, and convey the message of the management or the customers to the counterpart. As a matter of fact, it emphasizes the key role employees play to bring in new customers and improve customer loyalty. When we discuss customer relationship management, there are two sides to the coin. It includes customer conversion and customer retention.

Customer conversion focuses on capturing new leads, moving them through the sales cycle, and finally, converting them to loyal customers. Customer retention, on the other hand, concentrates on preventing existing customers from leaving your business. In short, it decreases the customer churn rate. According to a study, 89% of companies state that excellent customer service plays a huge role in improving the customer retention rate. In reality, the funds required to retain an existing customer are comparatively less when compared to the amount and time invested in converting a lead. It is also easier to sell a product to an existing customer than to a new customer. Owing to the belief that they trust your company, it is quicker for them to say yes to purchase a new product or service launched by your company.

This blog from Apptivo brings to you some of the most significant customer retention metrics that help companies to increase the customer retention rate and increase the customer lifetime value. Before dwelling on the top 5 ways to improve your customer retention rate, let’s have a look into what is customer retention rate and how to improve customer retention rate.

Customer Retention Rate Calculation

Customer retention rate is a prime metric that is a must-have while measuring the customer service metrics. It is measured as the percentage of existing customers who remain after a specified period of time. It is the rate at which you retain your customers over a particular period. Now, if you’re wondering what are the benefits of customer retention, you should never underestimate the importance of customer retention due to its financial advantages and the capability to improve the customer lifetime value. Apptivo has a cloud suite of CRM Tools that assist businesses of all types to enhance their customer retention rate. It doesn’t end there, Apptivo CRM also helps businesses to redesign their customer retention strategy based on the existing performance charts and reports. Apptivo is a customer retention software having detailed applications to serve the purpose of different departments in your organization.

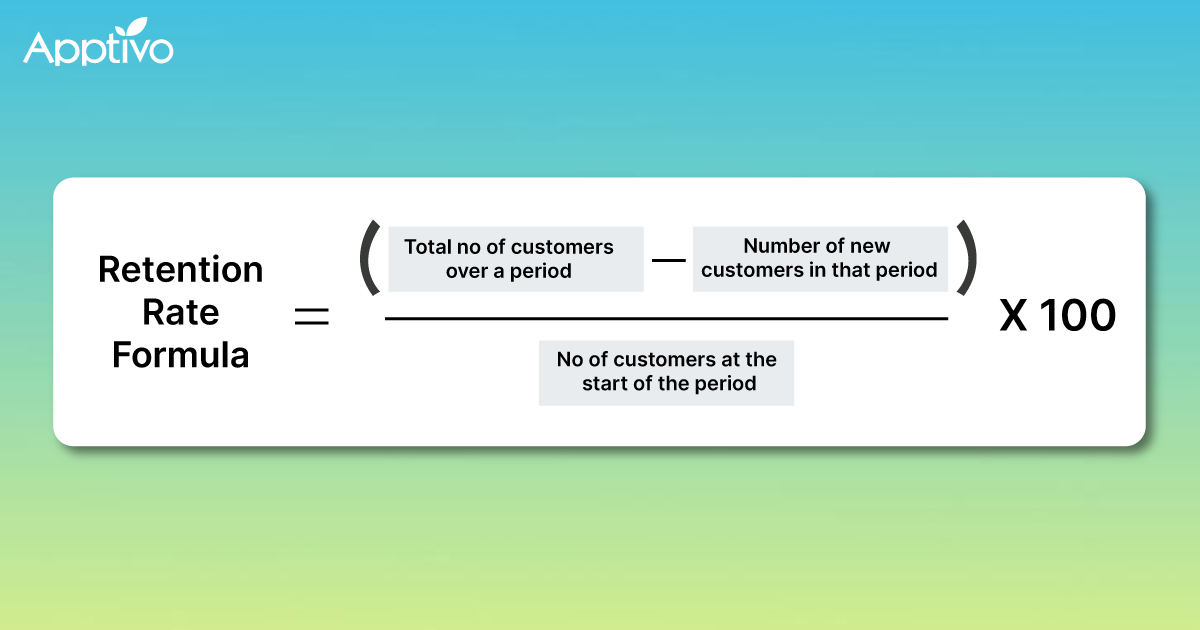

Retention Rate Formula is calculated by subtracting the total number of customers over a certain period of time from the number of new customers who joined your organization in that period. This is divided by the number of customers at the start of that period. Multiply it by 100 to get the value in percentage.

Retention Rate Formula

|

How To Improve Your Customer Retention Rate

Customer Retention Rate (CRR) is a broader concept that involves several other smaller factors that influence the overall customer retention value. In this section, we‘ll focus on a few customer service metrics that directly impact the retention rate and improve customer loyalty. By concentrating on these customer retention metrics, businesses can easily improve their CRR using a powerful customer retention software like Apptivo.

- Revenue Churn Rate

- Loyal Customer Rate

- Product Return Rate

- Time Between Purchases

- Customer Lifetime Value

Decreased Revenue Churn Rate

Revenue Churn Rate is defined as the rate at which an organization or a business loses their revenue due to customers leaving their business or downgrading their plan. It is also known as the MRR churn rate. By keeping track of your revenue churn rate, businesses can easily keep their customer retention rate in check.

Organizations should ensure that their MRR churn rate is a negative value. This is because a decreased revenue churn rate is an indication that the percentage of customers causing loss to your business is comparatively low. To maintain a negative value, employees should constantly stay in communication with their customers, get routine feedback on the products and services, and ensure that a proper solution is delivered to their problems and queries.

Revenue Churn Rate (Monthly) = [(MRR at the beginning of the month – MRR at end of the month) – MRR in Plan Upgrades for that Month] / MRR at the beginning of the month

Imagine this: The MRR of your company during November is $40K. The next month, you have incurred a loss of $10K due to churn and attained $3K from plan upgrades. By this, your revenue churn rate for December is 17.5%.

Increased Loyal Customer Rate

When you are running a business, customer loyalty is an important term that you can seldom skip. In fact, it is a pivotal part of your business and it simply means the level of willingness among customers to purchase your products or services repeatedly. Loyal Customer Rate(LCR) is defined as the total number of customers who have made repeated purchases with your business over some time.

By measuring the LCR, you can have an understanding of the number of your loyal customers. A positive LCR value is an indication that you have a better loyal customer base. The customer loyalty rate not only includes the number of purchases made by your existing customers but also includes the number of purchases made by your new customers. When you know your loyal customers, you can easily improve the retention rate. You can reach out to them for testimonials and encourage them to continue doing business with your organization.

Loyal Customer Rate = Number of Customers Making Repetitive Purchase / Total Number of Customers

Imagine this: For a particular month, you had 50K customers. Of this, 5K of your new customers and 2K of your existing customers made multiple purchases. Hence, the loyal customer rate for that month is 14%.

Lesser Product Return Rate

The concept of Product Return Rate is more apt for businesses that sell products and not services. Companies that sell products use this Product Return Rate as one of the factors to measure the customer retention rate. Product Return Rate is defined as the percentage of orders that have a product return. In short, it is the percentage of products that have been returned by the customers.

An increased product return rate is not a good indicator for the healthy operation of a business. It means businesses are not satisfied with your products. It should be a main aim of businesses to ensure that the product return rate is zero. A zero product return rate also means that your customers are happy with your product and there is a better chance of them retaining their purchase with your company.

Product Return Rate = Number of Sold Units Returned / Total Number of Units Sold

Imagine this: You have sold 10K units of your product during January month. Of this, 2K units were returned. Then, your Product Return Rate is 20%.

Reduced Time Between Purchases

While Loyal Customer Rate concentrates on the number of repeated purchases by a customer over certain periods, the concept of Time Between Purchases focuses on the time factor. Time Between Purchases calculates the time taken by an average customer to buy again from your company. This is one of the customer retention metrics that help to measure how satisfied and happy your customers are with your products and services.

A decreased time between purchases is an indication that your products are good and your customers are willing to make repetitive purchases. If your customers take more time between purchases, then it means that your product is not standing out from the rest. Hence, your employees should reach out to your customers to get proper feedback on your products and take steps to improve the products. By this, your customer retention rate can be improved.

Time Between Purchases = Total Number of Individual Purchase Rates / Number of Repeat Customers

Imagine this: Consider your business has 15 repeat customers. By averaging the average time taken by each customer to make a purchase again (30 days), you notice that the average time between purchases is 2 days.

Customer Lifetime Value

Customer Lifetime Value is another crucial customer service metric that helps you to boost your customer retention rate. Customer Lifetime Value is defined as the revenue generated by a customer during their lifetime with your business. An increased Customer Lifetime Value recommends that your business is working on the right track.

A decreased Customer Lifetime Value is a warning sign that indicates that your customer is shrinking or falling back on some level. This can be due to bringing in customers that are not a right fit for your company or your customers are leaving your business earlier due to faulty products that are not meeting their requirements. To improve your customer retention, it is recommended for businesses to maintain a higher Lifetime Value.

Customer Lifetime Value = Average Purchase Rate * Average Number of Purchases * Average Customer Lifespan

Imagine this: To measure the SaaS retention rate, you are measuring the CLTV. Here, multiplying the average revenue of $5K by an average lifespan of four years provides a CLTV of $20K.

Conclusion

In the above section, we have discussed some of the customer service metrics that you should consider in order to improve your customer retention rate. While the 5 metrics mentioned here are crucial, it is also recommended that you look into other customer retention metrics to boost your customer retention rate and decrease your customer churn rate. By integrating your business with Apptivo CRM, you can effortlessly track the performance of your sales, measure the conversion rate, calculate the customer retention rate, and increase your productivity.

Also, Read

- Role Of CRM In Travel And Tourism Industry

- 7 Practices To Optimize The Use Of Your CRM For Best Performance

- Know the difference between Sales Pipeline Vs Sales Funnel

Latest Blogs

Role Of CRM In Travel And Tourism Industry

Travel and tourism have been a significant part of everyone’s life since the ancient period. When we skim through the pages of history, It should be noted that humans were initially nomads before they became settled in one place. They...

Read more →

WHAT IS CRM TECHNOLOGY?

Introduction CRM is a technology that helps manage the entire customer information and interactions in order to build and maintain superior customer relationships. The CRM solution replaces spreadsheets and other different applications, which makes it easy for the businesses to...

Read more →

Everything you need to know about the Annual Maintenance Contract!

1. What is an Annual Maintenance Contract? 2. Benefits of Maintenance Contracts 3. How can Apptivo CRM help you manage maintenance agreements and vendors? 4. Summary Think about getting the confidence that the machinery is well-maintained and performing optimally, without...

Read more →