|

Introduction

The best way to understand and determine the growth of the business is by calculating the return on sales ratio(ROS). The return on sales ratio is a financial ratio which presents you with the overall revenue (the profit) and how much is used to pay down the operating expenses.

Today the business owners and investors prefer the return on sales ratio to be a useful one as it allows you to know and understand the percentage of dollars a company makes as revenue during a particular period. You can analyze the current performance of the business with the help of this ratio, irrespective of any industry and any size.

What is the return on sales?

Return on sales is an important and a simple metric. It is just a calculation of the percentage of profits earned by the company to the operating and maintenance expenses. This determines the sales ratio, and how much profit you have made over time.

It is very important to keep track of ROS data which gives a clear understanding on the performance of the company. Based on the data, you can devise future strategies and make corrective action whenever necessary. The company can have a clear picture on the expenses and profits easily as ROS is very simple to calculate.

Return on sales formula and its calculation

Return on sales can be calculated either in the form of ratio or a percentage. It provides a clear idea on the company’s profit margin. The return on sales can be calculated using the following formula:

|

Through this formula, the ROS comes in the form of percentage, you can keep it as a ratio if you want.

Return on sales formula:

Return on sales = Operating income/ Revenue

This formula helps you figure out how much revenue the company has earned over a period of time. Plus, you will know the expenses and liabilities of the company.

Components of ROS formula

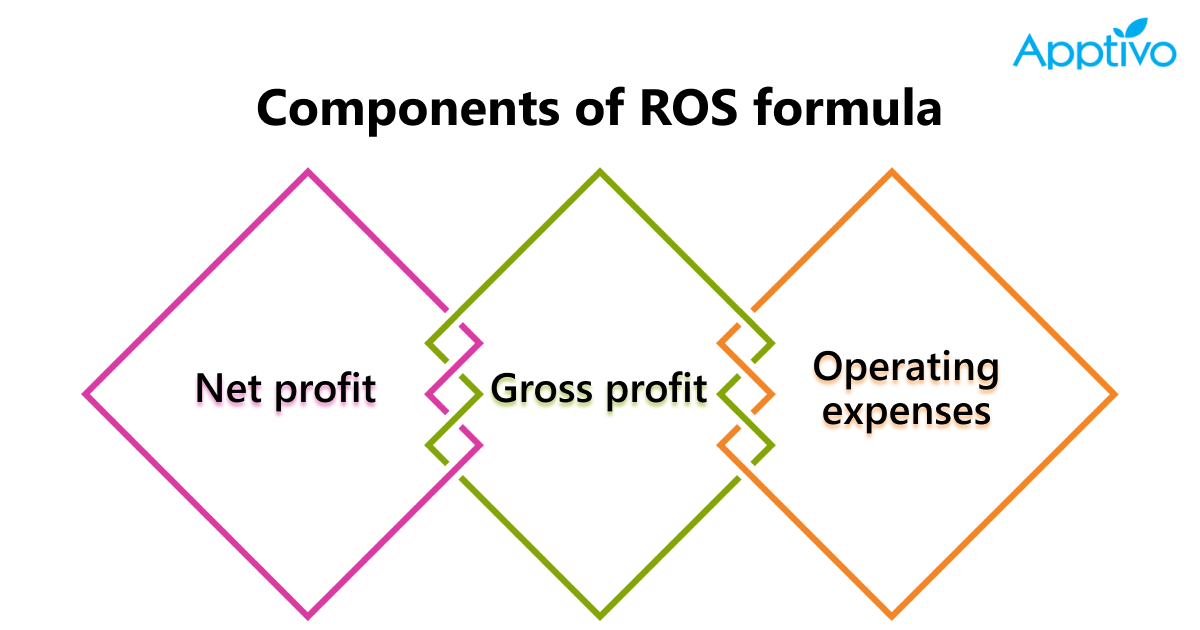

The main 3 components of return on sales formula are as follows:

|

1.Net profit: Net profit is the total amount of money you have, after all the expenses are paid for a given period of time. The net profit is calculated by subtracting the expenses from the revenue, after which you divide that number by the number of units sold.

2.Gross profit: There are two types of profit : Net profit and Gross profit Where net profit is the total revenue subtracted by the total cost for a given time period. While Gross profit is the total revenue subtracted by all the operating expenses.

3.Operating Expenses: Operating expenses are the expenses needed for the functioning of a business. These expenses might include the rent, the labor cost, the materials, and other utilities. Some other expenses might include the marketing costs, advertising costs and benefits for the employees.

Example of ROS calculation

Here are some examples that show you how to calculate and execute the formula in order to understand the performance of the company..

For instance, Let us assume that a business earns $500,000 in sales for a given quarter. The expenses for the same quarter is about $200,00. How to calculate the ROS in the given scenario.

Step 1: Calculate the net profit earned by the company. In order to find out, subtract the expenses from the total revenue. Which would be $500,000 – $200,000. The resultant profit figure is $300,000.

Step 2: Divide the profit by the total revenue. Which would be $300,000/$500,000.(operating profit/net sales). This gives the ROS of 60%. This figure represents the company will make 60 cents in profit for each dollar they earn in sales. You will get the resultant figure by taking into account all the expenses and maintenance costs related to the company.

Why Return on Sales is important?

Return on sales is one of the most used formulas in the business environment which is used to determine the company’s overall performance. Businesspeople, creditors and investors are interested in the return on sales function as it gives a clear idea on the company’s ability to pay the liabilities.

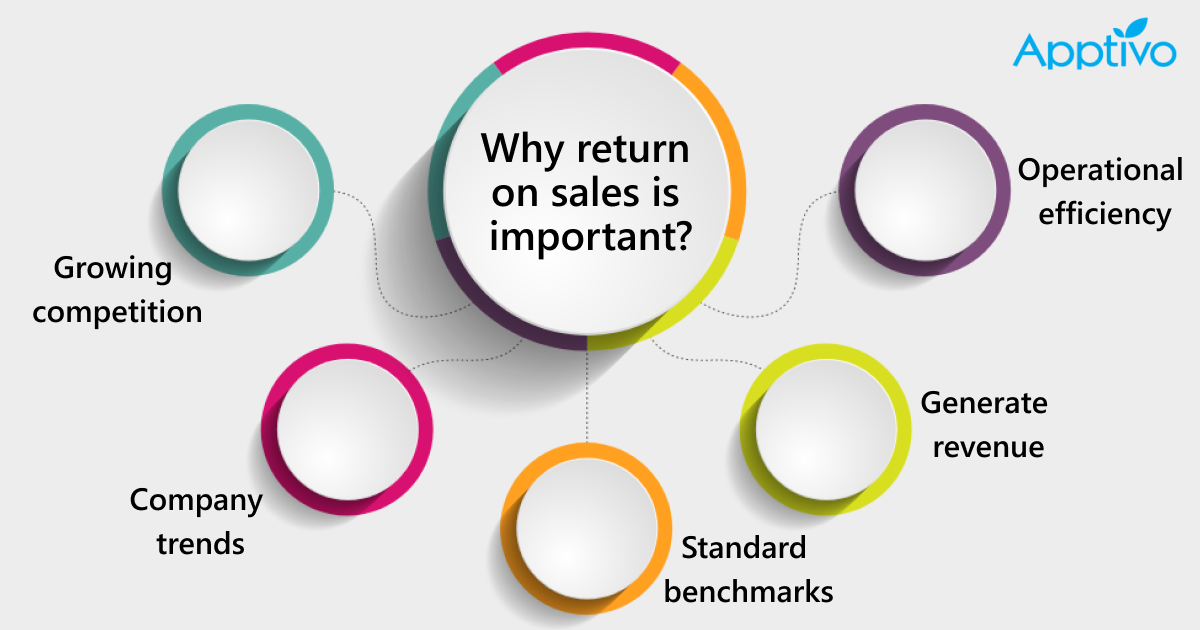

Also note that the company’s expenses and revenue could change every time and higher revenue just doesn’t indicate the company’s profitability. The company has to rely on the sales ratio which is considered as a dependable figure in order to understand and measure the performance of the company. There are many factors where your company depends upon the return on sales ratio :

|

1.Growing competition

You clearly know that your business and the competitors work and operate in a similar environment. Almost all the labor, material and other equipment costs are similar. All you can do is find a way to beat the competition if you generate a better return on sales ratio.

2.Company trends

You can clearly analyze your performance trends with the return on sales ratio. If the returns on sales are high year after year, it is completely clear that the company is performing well and is profitable. Also, a 10-15% increase in return on sales means that your sales numbers are increasing and you are managing the expenses quite well.

3.Standard benchmarks

Each industry has its own benchmarks being set to analyze and identify the level of profitability. Say for instance, if the return on sales average is 10% in your industry, an 15% ROS is considered a good one.

4.Generate revenue

One of the best ways a company can generate revenue is by increasing the sales numbers. Higher sales can be attained by effective sales promotions. The ratio helps you identify your status and how much effort you need to put in to generate revenue for your business.

5.Operational Efficiency

You can analyze the operational efficiency of your business by calculating the ROS ratio. In order to improve the efficiency, invest in a CRM software like Apptivo CRM tools that helps you effectively run your sales and manages the entire process from prospecting to closing deals.

Return on sales VS other metrics

Return on sales is often confused with other metrics, although each and every metric is different. Return on sales is a unique metric that presents you with an accurate picture on the performance of the company.

1.Return on sales VS Profit Margin

The net profit margin is simply calculated by dividing the net income with the revenue. Mostly in finance, the return on sales and profit margin are the terms used interchangeably in order to describe the financial ratio. The main difference between these two is that it uses earnings or income before interest and taxes which is denoted as EBIT. Some might get confused with EBIT and EBITDA. EBITDA is simply the earnings before interest, depreciation and amortization. Most of the creditors and investors feel that net profit margin is not a true measure of operating cash flow and does not depict the overall financial health.

2.Return on sales vs Return on equity

Return on equity refers to the difference between the assets and liabilities of a company. Return on equity (ROE) is a measure of what you get as a return on your investment from the company.

3.Return on sales vs Return on assets.

Return on assets (ROA) help you determine how the assets are efficiently used by the company to generate profits. If the company does not have any debts, the ROE and ROA will be equal. If the debts increase, the ROA will decrease.

4.Return on sales vs price to sales ratio

Price sales ratio is a metric that is used to describe how much one share generates in revenue for the company. The p/s ratio does not take into account the cash flow or profits and is purely based on the sales figures. It is considered as an inappropriate formula when assessing the stock price and market value of new companies.

5.Return on sales Vs Return on capital employed

ROCE is a financial ratio which is calculated by determining the earnings of a company before interest and taxes (EBIT) and dividing that by the total capital employed. This ratio helps you determine how much a company earns in profit versus the efficiency of the applied capital.

How to use return on sales ratio to improve sales?

The return on sales ratio is an important and vital metric which would be useful in improving the sales process. The company’s sales are usually determined by the metrics that the company uses.

With the help of return on sales ratio, you can analyze the efficiency and profitability of a sales process. You can also plan your sales cycle with the resources you have in hand.

Let us for instance see a simple example on how the ROS can improve your sales and thereby profitability.

“Company A generates $600,000 of business each year and has an operating profit of $200,000 before taxes or expenses. The return on sales is calculated as follows: $200,000/$500,000 = 40%

In this case, the company converts 40% of sales into profits and spends the remaining 60% to run the business(Expenses). If company A wants to increase its net operating income, it has to either increase the revenue or decrease the expenses.

If the company decides to maintain the revenues by reducing the expenses, the company will be more profitable. But in reality, it is difficult to reduce the expenses, what can be done instead is to maintain the existing expense numbers.

You need to have a well structured sales plan and a sales process which helps you to close more deals effectively thus enhancing the profitability of the firm. Also, the company needs to identify the best sales techniques to cut down the costs and keep the processes running smoothly. With the help of a sales CRM, you can realize an increase in return on sales ratio.

Final thoughts

A company has to measure its revenue, investments, expenses and sales in order to analyze its growth and performance. The return on sales metric is important and vital for all the businesses to get a clear picture of your revenue and expenses. This helps you get transparency over your company’s status and lets you devise strategies for future growth.

Latest Blogs

Role Of CRM In Travel And Tourism Industry

Travel and tourism have been a significant part of everyone’s life since the ancient period. When we skim through the pages of history, It should be noted that humans were initially nomads before they became settled in one place. They...

Read more →

WHAT IS CRM TECHNOLOGY?

Introduction CRM is a technology that helps manage the entire customer information and interactions in order to build and maintain superior customer relationships. The CRM solution replaces spreadsheets and other different applications, which makes it easy for the businesses to...

Read more →

Everything you need to know about the Annual Maintenance Contract!

1. What is an Annual Maintenance Contract? 2. Benefits of Maintenance Contracts 3. How can Apptivo CRM help you manage maintenance agreements and vendors? 4. Summary Think about getting the confidence that the machinery is well-maintained and performing optimally, without...

Read more →